Our strategy is to invest in equity markets, based on the principle of investing for positive returns regardless of market direction. The Funds have fewer constraints than many other funds in terms of having to benchmark to indices and face restrictions on the type of investments allowed.

Technical + Fundamental = Stronger Returns

We use a multi-disciplinary approach. Specifically, in trading asset markets we combine technical analysis with fundamental analysis to identify major trends which display favourable risk/return profiles.

Asset markets which the funds analyse include equities, options, futures, commodities and ETFs.

We have structured the funds to be as flexible as possible within guidelines. The funds’ constitutions allow the trading of stock market indices as well as listed securities both long and short. They may also use options and futures to hedge or better position the portfolios. This will assist the funds in being able to profit even if the market falls.

We spend a large amount of time analysing the stock market itself, in order to assess the “mood” of the market and what we believe is the “risk” in the market. To do this we analyse time cycles, sentiment and other technical factors.

Our aim is to identify trends, enter those trends when the risk/reward ratio is favourable and stay with those trends whilst we think that ratio remains favourable. The duration of the trends in which we invest vary depending on market conditions. Accordingly, trends can be both short-term and long-term.

We use both fundamental and technical analysis tools for stock selection and use technical analysis to identify the buy and sell triggers.

Fundamental Analysis

At TI we adopt both a top-down and bottom-up approach to fundamental analysis. This involves the management of an internal global macro-economic model which forms the basis of our fundamental view on the global economy; helping us to identify potential new trends and therefore sectors of interest.

In addition to identifying potential regions or sectors of interest, this approach also assists our evaluation of future changes to market sentiment or conditions. We constantly compare our global outlook with market consensus (i.e. what the market is expecting) to see whether there is any variance which may become a triggering event for a price change or a catalyst for a new trend.

Once we have identified a new trend of interest we undertake a more detailed analysis of companies involved in that sector i.e. bottom-up approach. This involves the analysis of companies using traditional valuation techniques overlaid by factors specific to each company analysed.

Technical Analysis / Behavioural Finance

We have carried out extensive analysis on how markets and stocks behave. Whether the market is topping, bottoming or trending it will generally behave in a certain way.

We use various tools to assess the market’s mood and direction. These include time cycles, buying and selling pressure, price movement patterns, sentiment readings and various proprietary chart analysis techniques – all of which enable a judgement on how the masses are feeling about the market and individual stocks. This helps us to identify excess optimism and pessimism.

Both fundamental analysis and technical analysis allow us to select sectors we wish to invest in and to identify individual stocks to watch. We then use technical analysis as a tool to determine buy and sell points.

A large part of reducing risk and profiting consistently in the markets is knowing when not to risk capital. Investing substantially only when the odds are loaded in our favour is critical. We have structured the constitutions of the funds such that they allow for flexibility and the possibility to increase the funds’ value in all market conditions.

The funds are managed from an Australian investor’s perspective.

Currency exposure within the funds is actively managed with the objective of delivering positive $A absolute returns. Protecting stock returns or minimising the risk from currency movements is the major consideration in currency hedging. The level of hedging will depend on the Manager’s expectation of future currency exchange rate movements.

Technical Investing’s proprietary investment process

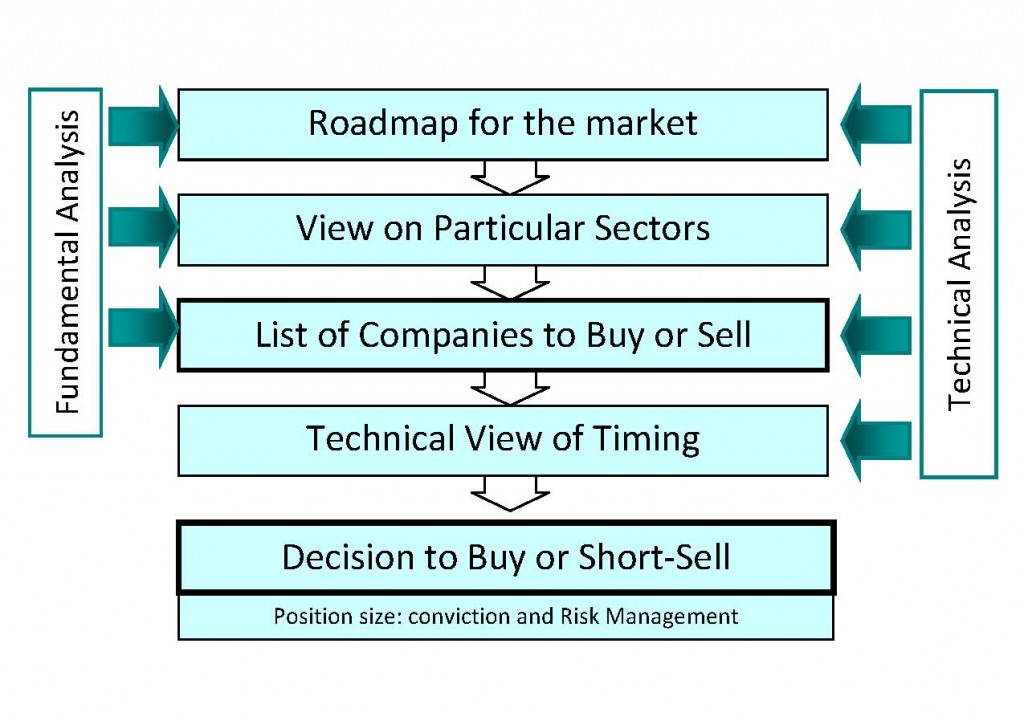

Our investment process is summarised by the diagram below:

1) Roadmap for the market

We form a view on the overall market. This is done through carrying out fundamental analysis on the economy and market to form a macro view based on economic data, etc. At the same time we carry out technical analysis using time cycles, trends, history, sentiment, etc to form a view on the probability of the future direction of the market. This becomes our “Roadmap for the market” – addressing questions such as: Should we be more heavily long or short? What are the risks in the market? What probability do we give to it moving in a particular direction?

2) View on sectors

We see ourselves as thematic investors – looking for major themes and trends. At particular points in time certain areas of investment tend to perform better. We look to identify those areas where there is a large change occurring. For example, fundamentally we may identify the potential for a large increase in demand for a commodity over the coming years, yet supply may be tight, forcing prices up in that area. Having identified the opportunity we will research that sector and industry.

Alternatively, we may come across a group of stocks performing well technically and this leads us to review that sector.

3) Specific companies

Having identified an industry or sector of interest we then look within the sector for companies that we believe will offer good risk/reward options. We review the stocks and select those on which we wish to carry out further detailed analysis. This will be through a combination of fundamental and technical analysis.

We may also at this point identify stocks that have not come to attention through the sector review but have been suggested to us through our network of contacts, or appeared through one or more of the technical scans that we carry out.

4) Timing

By applying technical analysis to each investment we believe that we can substantially improve the timing of buying and selling. The reasons we do this have been discussed above and can be elaborated on in a full presentation. The ability to time investments based on our technical analysis will allow us to better assess the risk/reward for each investment and, we believe, substantially improve long term results.

5) Buy or Sell

Once we decide to enter a position by buying long or selling short we assess the reason for that trade and determine the size of the position. We will take into account our conviction on that position; our assessment of the risk/reward of the position.

The same analysis feeds into our decisions on current holdings. We continually review positions within the portfolio to determine whether we need to increase or decrease any holdings.